Recently, there has been more and more talk in e-commerce about cross border and expansion into foreign markets. This is not surprising since, according to the Baselinker Index, stores operating in more than one market are growing on average 2-3x faster than their domestic competitors. Nevertheless, there is no rose without thorns. Entering a new market presents a number of challenges. Including logistical ones, which can seriously affect operating margins.

So what to consider when planning international expansion in the e-commerce channel? How do you prepare your operations so that revenue growth is not offset by excess cost growth?

Much depends on how we approach the project of entering new markets. As well as on our preparation in the areas of finance, transportation, and legal areas.

In this article, I will share my observations from building a European distribution network for one eCommerce aggregator. If you don’t want to make the same mistakes in your business I invite you to read on.

CROSS BORDER HAS NOT ONE NAME

Before we get to solutions, we need to define in which model sales to foreign markets will be realized in our case. From the perspective of selling in Europe, consciously not going into the options of so-called drop shipping, we actually have two options. Both have their pros and cons and their associated challenges.

CLASSIC CROSS BORDER

The first is to start selling to foreign markets directly from our existing warehouse and fulfill orders on the so-called long last mile.

This classic model has many advantages. First, it does not require significant changes to our existing operations. Both the deliveries to our logistics network and the processes inside the warehouse are essentially unchanged. We continue to receive and store goods in-house.

The only significant change will be at the level of organizing deliveries to the customer. If we decide to enter some markets in Southern Europe, we will have to consider signing additional contracts with courier companies that have better coverage and shipping rates for these directions. We can choose from operators such as Packeta, Olza Logististics, and others depending on the market.

If we are thinking of selling primarily to Western Europe, the first place to look is to explore the market using DHL, which is still the most economical form of delivery to all major European markets except the UK.

However, such a classic cross border e-commerce model has two major drawbacks.

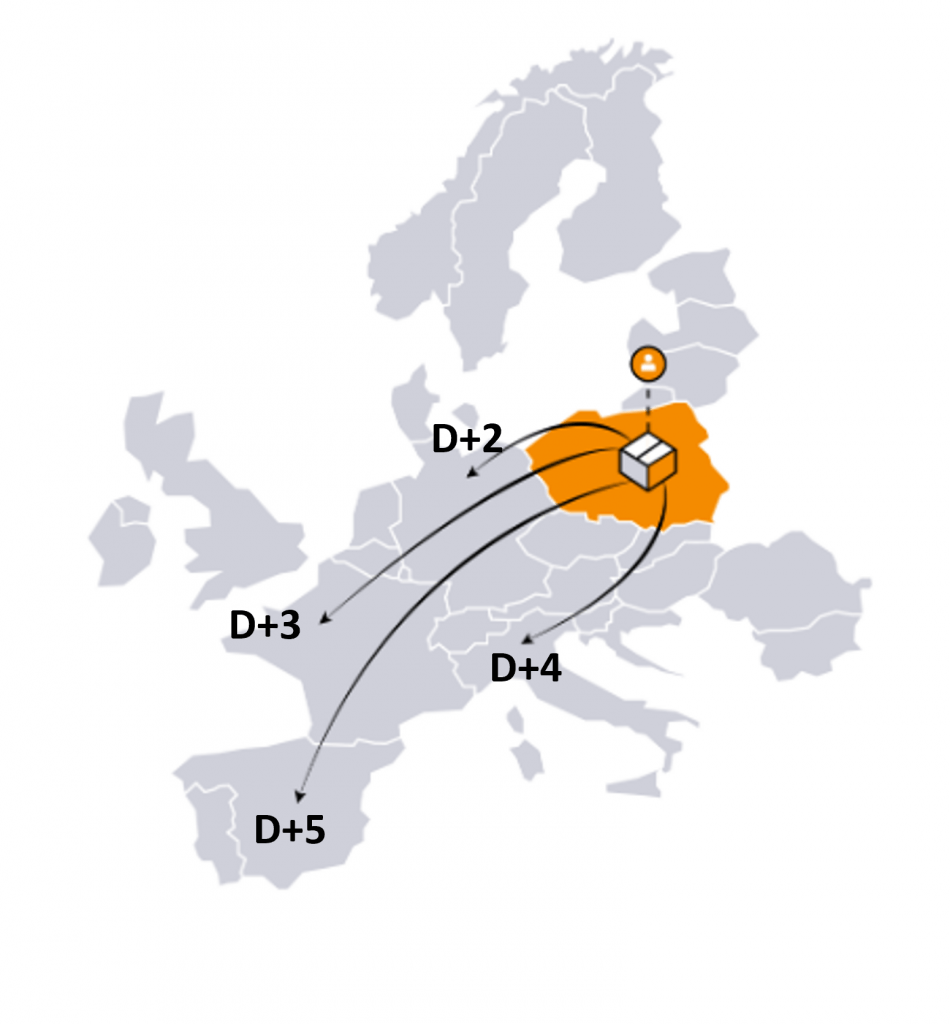

First is the delivery time. No matter how well we organize operations inside the warehouse. Regardless of whether our integration with marketplac or our own store will work on the fly. We have to take into account that deliveries from CEE to most markets outside Germany will take 3-4 days.

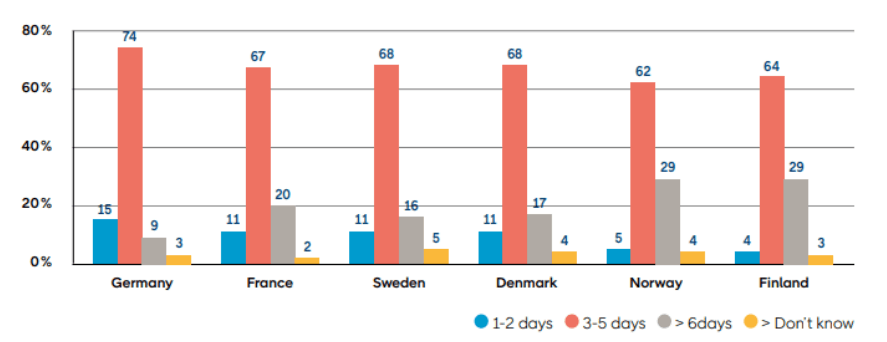

Can our customers accept this? On the one hand, Post Nord research indicates that Europe does not necessarily need speed. On the other hand, however, it is a factor in conversion.

If you are interested, I encourage you to read that article. On the other hand, to briefly summarize the dependencies in one sentence – time plays less of a role the more unique the product is. In the case of competition in our product category, and especially when we sell not through our own website but through a marketplace, delivery time starts to matter more and more.

Secondly, the classic cross border model involves much higher delivery costs. Even the “most economical” form of delivery from Poland or other CEE country to Western markets I mentioned earlier will be 2-4x more expensive than domestic delivery.

Of course, everything depends on the volume of shipments we will be sending to a particular country. However, even with significant volumes, the relationship will always remain the same. An international shipment will be more expensive than a domestic shipment, and this must be factored into the price level upfront, or passed on to the customer, in our sales channels.

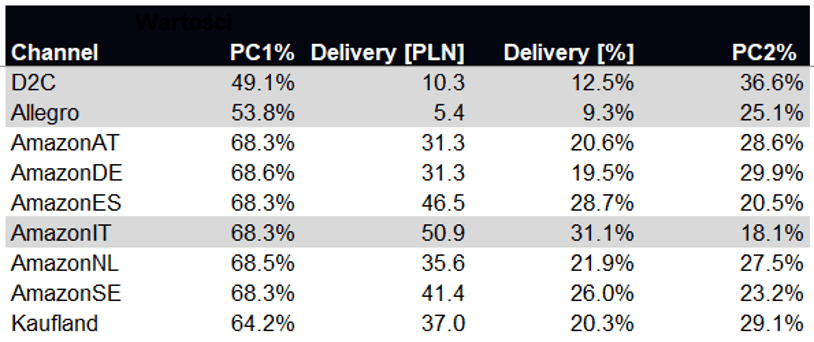

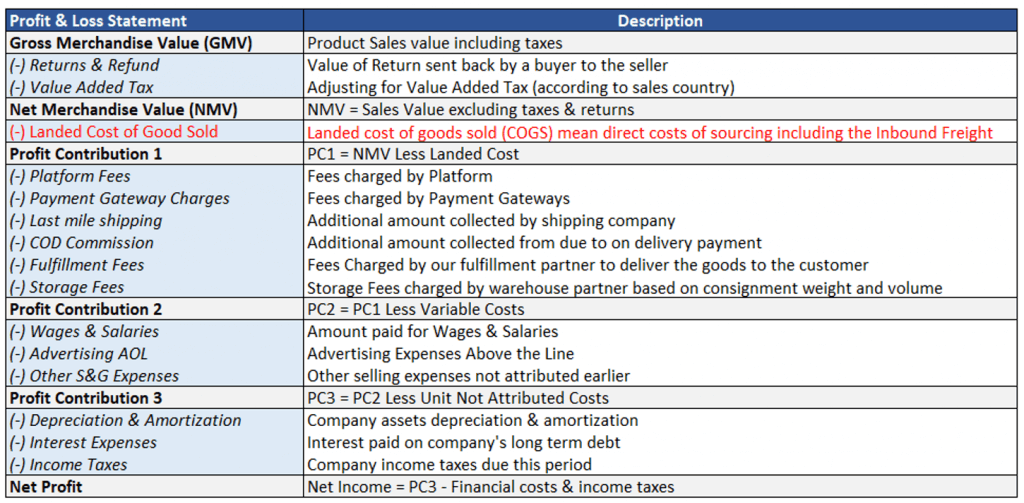

Otherwise, our operating margin or second level margin (from Profit Contribution Lvl2, PC2) may come out below the operating margin in the domestic market. Even if the direct sales margin, that is, the first level margin (from Profit Contribution Lvl1, PC1) is higher in foreign markets.

Unfortunately, this is also how it worked out in the first months of entering foreign markets of the aggregator I mentioned above. The commercial team aggressively approached price levels in an effort to grab market share. We had to deal with the effects at the operational level. However, this only became possible when we entered higher sales volumes and were able to take advantage of further thresholds of courier pricing.

What do “higher” volumes mean? As I write this article in practice at least 30,000 packages per country per year. At that level, you can already either negotiate better terms or use an international broker such as Bringg or Seven Senders.

SOFT INTERNATIONAL EXPANSION

But what other options do we have? What if time is of the essence in our product category? After all, not everyone sells furniture, where the customer, as eCommerceDB’s more detailed research indicates, can wait up to 3 weeks?

What if we sell products in impulse categories, or on a marketplace that puts a premium on delivery time and doesn’t show our offerings to customers if we don’t meet the sub-2-day delivery standard?

Note: The above summary should be read with some caution. On the one hand, it is more detailed because it shows the desired delivery times in various categories. On the other hand, these are averages from all countries included in the survey. So the Post Nord and eCommerceDB results cannot be directly compared.

What can we do if we sell, for example, cosmetics? or other so-called sortable products that, when completed, packed, do not exceed 4-5kg in a package?

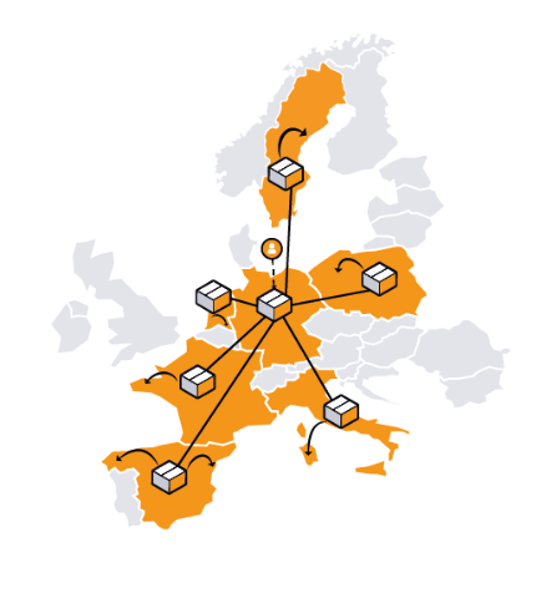

Then you can consider entering new markets with the cooperation of a logistics operator that has warehouses located in Europe. Contrary to appearances, this does not have to be a very complicated solution from the organizational and technical side.

Nowadays, it is not only the largest operators that offer integration opportunities using OMS (Order Management System) type systems. Also a number of smaller, local, operators integrate without problems with solutions such as Baselinker, Channel Advisor, Open Bravo or others.

However, when deciding on this model, it is important to remember that at the beginning we will have to go through a number of administrative procedures. It is no longer enough to merely register for VAT OSS. It is necessary to register as a VAT payer in each country where we will hold stock, i.e. one from which we will make sales.

In addition, it is imperative that we register with the Waste Database and information collection systems appropriate to the country. In France this will be Adelphe, in Italy CONAI, in Spain SIG and in Germany LUCID.

Once we go through the registration procedures, however, we gain the ability to fulfill our customers’ orders faster than in the case of classic Cross Border, and everything would be beautiful… if it weren’t for the issue of operating margin settlements, which unfortunately become more complicated in this model.

WHAT IS LANDED COST?

When we decide to sell from several different points, we need to start going to the next level of detail in our financial and accounting system, or at least in the reporting built on it.

First of all, what will change in our cost model is the approach to determining the cost of products (COGS, Costs of Goods Sold), which are normally included in the first level margin – the previously mentioned PC1.

In this model, we need to keep in mind the total cost of making the product available for sale, which is the so-called landed cost, which also includes transportation costs. In the case where we have one warehouse this is simpler because we only have to take into account freight costs to our main warehouse.

When working on multiple warehouses, transportation costs within our distribution network must also be considered. The table above shows a framework Profit and Loss Statement in which transportation between warehouses is in the red line and not below in operating expenses.

This is important because whatever we do in organizing our logistics, sales from subsequent points lower in the distribution network will always be more expensive than sales directly from our first, main, warehouse.

If we don’t take this into account then we lose transparency about how our sales margins are distributed. This is also one of the problems we faced when I helped build the distribution network of the aforementioned aggregator. The ERP system used by the company was unable to assign transportation costs to product costs. At the same time, it did not assign them to operating costs.

As a result, until a fix was uploaded the margin level in some markets in Europe was hypocritical. Overall, we saw the result of the entire Business Unit. In contrast, we had a distorted perspective on the impact of individual markets.

WHICH MODEL FOR ENTERING NEW MARKETS TO CHOOSE?

It is not possible to point to one specific model for entering new markets. Both classic Cross Border and expansion into new markets using logistics operators have their pros and cons.

The choice depends on the customer’s expectations of our product category, the logistics service standards already imposed by the competition, and the level of competence within the organization.

Classic Cross Border is simpler to implement. That’s why many companies choose this model in the first place, reckoning with constraints on delivery times and increased logistics costs.

Deploying your inventory in other countries, entering into cooperation with logistics operators, is not technically difficult. It allows you to get closer to the customer. When it is well planned it also makes it possible to reduce logistics costs relative to classic Cross Border.

Note: Comparing the prices of operators’ services in Western Europe with domestic ones, it will obviously be a more expensive solution at the level of warehouse operations themselves (receipt, storage, picking of the Customer’s order). Nevertheless, through lower delivery costs in a given market, it can be an overall cheaper logistics option than an in-house operation in Poland plus the long last mile that takes place in a classic Cross Border.

It’s not just major eCommerce businesses like MODIVO, which has decided to expand internationally and is opening a warehouse in Romania. Also, smaller organizations such as Deeze and Cossibella are selling Cross Boder to Ukraine, and ANSWEAR.com to several more markets in Southern Europe.

Battery Empire, which is a Green Cell brand store, is available in 10+ languages and fulfills orders for Europe not from Poland but from warehouses in the west of the continent.

All of this shows that entering new markets is not as scary as they paint them and business with 50-150mln EUR can easily do it as well 😉